Business Insurance in and around Chicago

Calling all small business owners of Chicago!

Cover all the bases for your small business

Business Insurance At A Great Value!

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

Calling all small business owners of Chicago!

Cover all the bases for your small business

Protect Your Business With State Farm

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like business continuity plans or a surety or fidelity bond, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Cater Minnis can also help you file your claim.

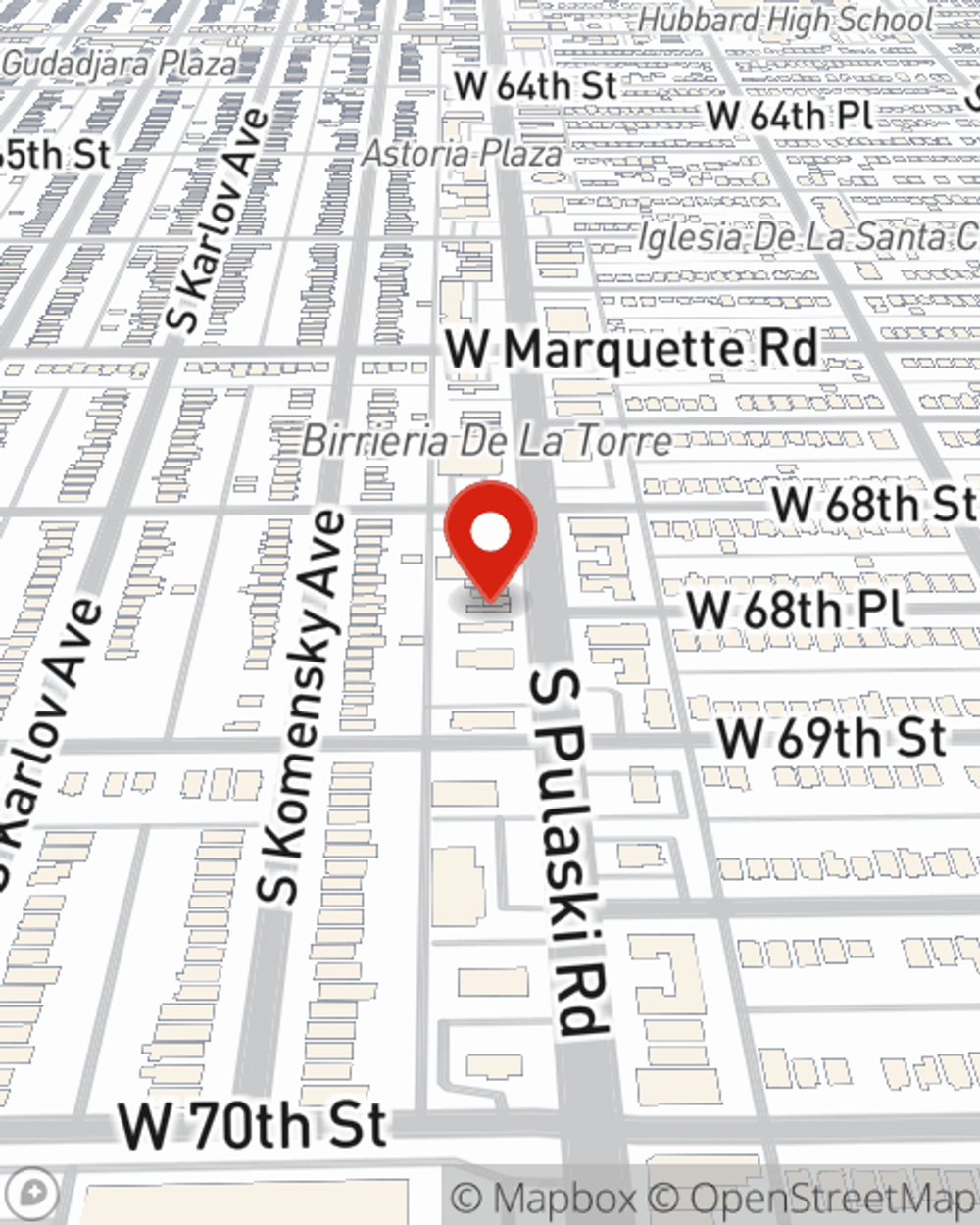

Take the next step of preparation and contact State Farm agent Cater Minnis's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Cater Minnis

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.